New Income Tax Rules for Real Estate 2025

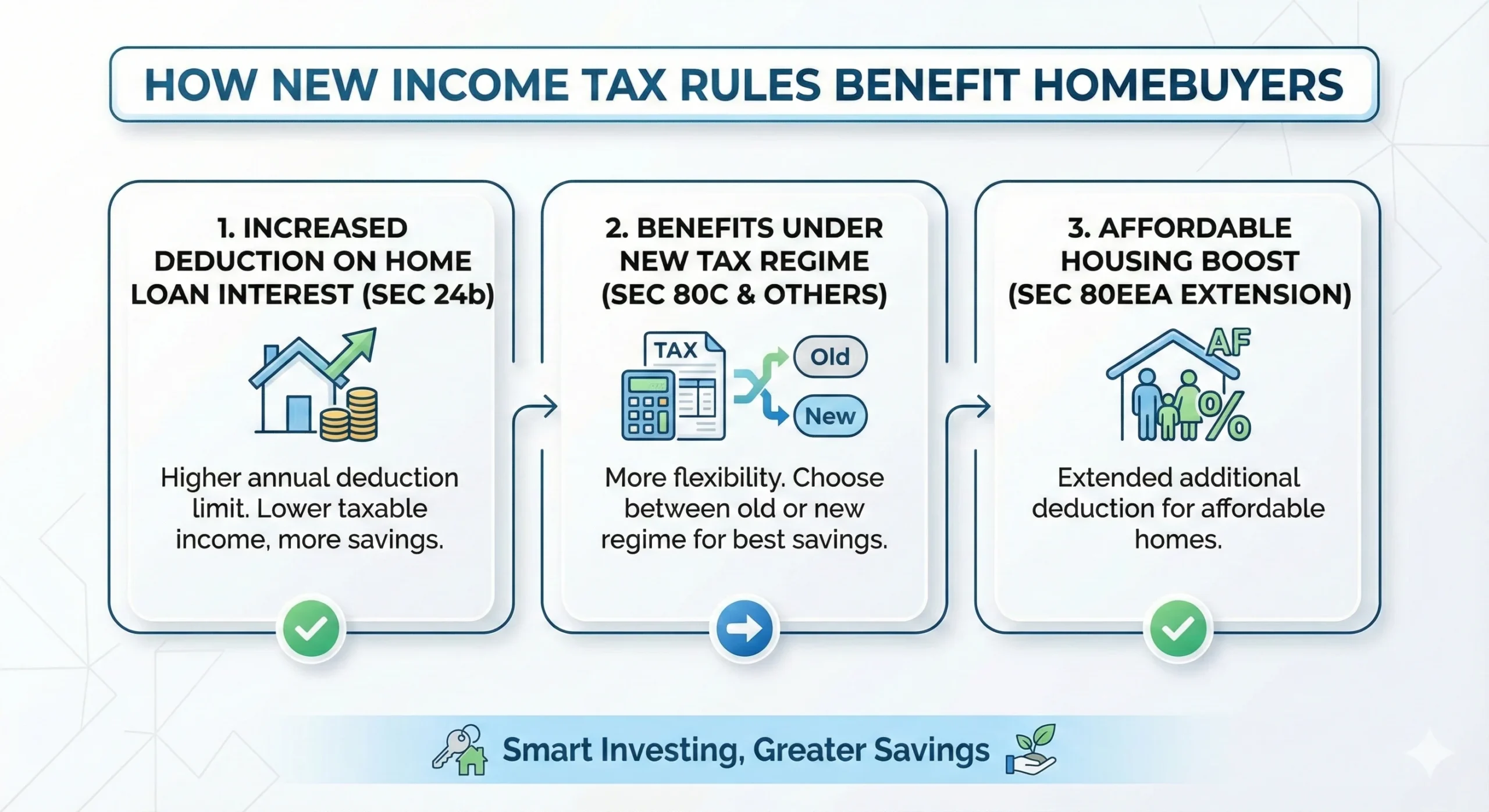

Starting April 1, 2025, the new income tax rules are set to bring much-needed relief to homebuyers in India. These updates are not just about minor tweaks to tax slabs — they represent a significant shift toward supporting middle-income earners and encouraging real estate investment, especially in residential housing.

One of the most impactful changes is the increased tax exemption limit. With the new income tax rules, individuals earning up to ₹12 lakh annually may enjoy full exemption under the revised slabs. This means more savings in hand, which directly improves affordability for aspiring homeowners. Many families who were previously hesitant about committing to a home loan may now find it easier to budget for monthly EMIs without financial stress.

Additionally, tax benefits for self-occupied residential properties have been expanded. Previously, tax deductions were available only on one self-occupied home. From April 1 onwards, individuals can now claim benefits on two self-occupied properties. This is particularly helpful for families who may own a primary residence in the city and a secondary home in their hometown or vacation destination.

First-time homebuyers also stand to gain with the extended availability of additional interest deductions on home loans. This move will lower the overall borrowing cost and encourage younger buyers to enter the real estate market earlier in their financial journey. At a time when housing prices are steadily climbing, this tax relief adds a much-needed cushion.

Another noteworthy update is the raised standard deduction for salaried individuals. With higher take-home pay, more buyers may become eligible for better loan amounts, enhancing their ability to invest in higher-value homes or in premium residential projects.

Overall, these new income tax rules are a strategic push by the government to make homeownership more achievable. They address both affordability and accessibility, encouraging more people to consider buying property in 2025. Whether you’re a first-time buyer, a young professional, or looking to invest in a second home, these income tax changes could work strongly in your favor.

In conclusion, April 2025 marks the beginning of a more buyer-friendly era in real estate. With smart planning and awareness of these new income tax rules, homebuyers can make informed decisions and unlock real value in their property investments.